The Year Christmas Retail Was Different

16 December 2020

By Sophie Barber

We’re sure you’re probably tired of hearing about what a ‘strange’ and ‘unprecedented’ year it’s been but we wanted to take the time to acknowledge just how different Christmas shopping has been this year.

England was in lockdown from the 5th November to the 2nd December (and restrictions were also in place in other parts of the UK) which would usually be a prime period for Christmas shopping.

The lockdown did end on the 2nd as promised, with many wondering if this was done to ensure people had time to visit the high street and do their Christmas shopping, but many of us had already done our shopping online.

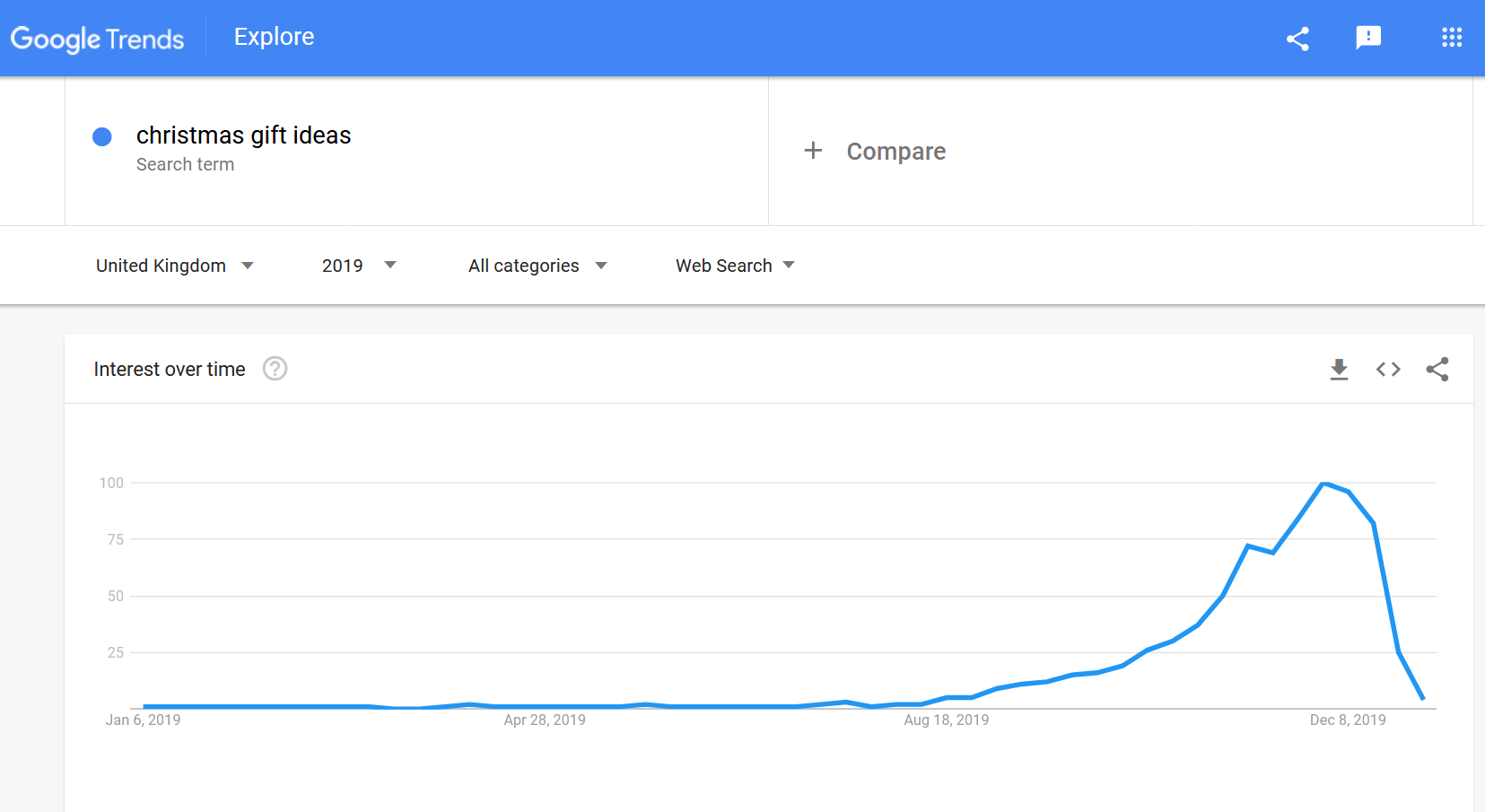

Google Trends data showing the popularity of searches for ‘Christmas gift ideas’ in 2019. It suggests that late November and early December are peak times for Christmas shopping – part of the time England was in lockdown this year.

Indeed, the infamous Black Friday sales, which occured on Friday 27th November (although some went on for the whole week), were almost exclusively online this year! While many deals and sales were happening online, any brand that typically relied on in-store footfall on Black Friday really missed out.

All in all, it’s clear that businesses have been forced – this year more than ever – to adapt to the world of online retail, and those that were able to adapt and rise to the challenge have thrived.

Setting the scene – a ghost town on Oxford Street

As we mentioned, the high streets were closed for a month and, even on reopening, they may not have been as busy as expected with COVID-19 restrictions in place.

This has meant that planning ahead to enhance the in-person shopping experience has been futile this year. A key example of just how strange Christmas retail has been can be found in a PR stunt pulled by Playstation at one of London’s busiest tube stations.

To celebrate the launch of their latest console, the PS5, Sony changed the signs at Oxford Circus to match the buttons on a PlayStation controller – a square, circle, triangle and cross.

(Image credit: Creative Bloq)

Now, Oxford Street would usually be the best place to do this in November, with so many people out to start their Christmas shopping and enjoy the Christmas lights (in 2019, the footfall for retailers in the West End was estimated to be 42 millions shoppers, spending around £2.5 billion). However, this PR stunt came right in the middle of the November lockdown and Oxford Street was largely deserted!

We’re sure that PlayStation had no problem with the sales of their new console, but this example demonstrates how planning marketing activity has been extra tricky this year!

(Image credit: The Verge)

‘The death of the high street’

As well as all the headlines around the coronavirus vaccine and the Brexit deadline, a big focus these past few weeks has been the collapse of certain notable high street stores. This has been a theme for a few years now, but really seems to have been magnified by the ‘Christmas shopping in lockdown’ period.

The main company that has been the subject of headlines is Arcadia Group, a fashion giant which includes big-name brands like Topshop and Dorothy Perkins. Aside from the not-so-positive reputation of owner Phillip Green, which has been tarnished by the collapse of BHS and allegations of sexual assault, much of the criticism levelled at Arcadia has interestingly been related to its failure to fully maximise their online offering to compete with brands like ASOS and boohoo.

Quoted in a BBC article, Julie Palmer, partner at professional services firm Begbies Traynor, said: “While the Covid-19 crisis has undoubtedly accelerated the company’s decline, in reality, the writing had been on the wall for Arcadia for some time. Its competitors forged ahead with high-profile online propositions that it simply failed to match.”

In general, the commentary has been that a resistance to change has led to the failure of certain brands on the high street with a traditional bricks and mortar presence. The debate has started around whether we need to ‘save the high street’ versus the fact that brands simply need to evolve with the times and acknowledge that they may no longer need ‘bricks and mortar rent’.

The winners of online retail

How successful certain brands have been does depend quite heavily on what they are selling. As KPMG retail partner Don Williams said: “The gap between winners and losers is stark with home-related items, like furniture and technology, putting in a strong performance while the improvement in fashion sales was short-lived.” He continued, “Digital strategies have never been more vital, but those strategies must be cost-efficient, too.”

It is clear that certain brands are at an advantage during this pandemic. However, a willingness to embrace online retail has also ensured that certain companies have been able to thrive this year, in the face of adversity.

For example, Naturalmat, a brand who sell natural and handmade mattresses and who typically have both a showroom and online presence, have really benefited from maximising their online presence through advertising. Despite having showrooms closed during November, they have had their best Christmas season yet in terms of sales.

Owner Mark Tremlett told us: “2020 has been an extraordinary year… from a promising start in January to staring into the abyss on 23 March and then a slow recovery in late spring, followed by an avalanche of interest from the summer until now; this year has really been a rollercoaster that we will not forget.”

“We have been exceptionally fortunate that the pandemic has forced consumers to stay at home, with the result that in the absence of any holiday spend, they have diverted by investing in interiors and their gardens. The greatest revelation we have seen over the autumn and during the run-up to Christmas is the increased consumer confidence to buy our beds and mattresses online.”

Indeed, brands like Halfords have undoubtedly benefited from the surge in people wanting to jump on their bikes but they have also successfully adapted their business model to deal with a changed retail landscape.

As their IT director Neil Holden explained in a Retail Week article, “We created a fast start plan early on in lockdown. We’ve enhanced the proposition, the acceleration in digital transformation is exponential. This quarter, we’ve invested £3m in digital technology.”

Its digital transformation has included launching new apps, digitising manual processes, a new group data platform, and optimising the booking and scheduling for the motoring business.

Moreover, when it came to Black Friday, many brands decided to spread their online promotions and discounts over a longer period in order to ease pressure on the supply chain (and shops once they reopened).

This seemed to prove successful for many – according to Retail Week, John Lewis shipped nearly 3 three and a half million products during its Black Friday Sale, which ran from November 20 to 30, which it said was a “new record demand”.

Another winner was online retailer Cult Beauty, whose promotions were “extremely well-received this year”, with units sold 38% higher than Cult Beauty’s previous record.

Shop small and local

While the emerging theme of this Christmas retail period is that optimising your online presence is the key to survival, another message that has been hammered home more than ever this year (and rightly so) is the idea of shopping small, independent and local.

People have seen just how badly small businesses have been affected by the pandemic, and are keen to help them out more than ever.

We believe that the message of backing small, local businesses has been important this year and will continue to be so in the coming years, as a sense of protectiveness over those small and independent shops and businesses – which have seen a lot of difficulties during the pandemic – endures.

As well as making sure they have a relevant online presence, businesses will do well to focus on a more personal and human angle in order to appeal to consumers into the future.

So, there we have it – our deep dive into Christmas retail during 2020! We hope you enjoyed this blog and make sure to keep your eyes peeled for future insights.